Cryptocurrency has become a popular investment option in South Africa, but navigating the market can be overwhelming. To help you make informed decisions, we’ve compiled expert insights and tips for buying cryptocurrency in South Africa. Read on to learn how to invest wisely and stay ahead of the curve.

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for security. It operates on a decentralized platform known as blockchain technology, a digital ledger that records all transactions across a network of computers. This decentralization ensures that no single entity or government can control the currency, making it a secure and transparent form of financial exchange.

Popular cryptocurrencies, such as Bitcoin, Ethereum, and Ripple, work through a process called mining. Miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. In return, they are rewarded with newly created coins. This process ensures that the currency remains scarce, valuable, and resistant to counterfeiting.

The history of cryptocurrency in South Africa started in 2009 with the introduction of Bitcoin. At first, the digital currency was met with skepticism and uncertainty, but as it gained global recognition, South Africans started to take notice. In the early years, cryptocurrency was primarily used for online purchases and as an alternative investment option.

Over time, the South African government has taken a relatively open approach to cryptocurrency regulation. In 2014, the South African Reserve Bank (SARB) issued a position paper stating that virtual currencies would not be considered legal tender but could be used for transactions, subject to certain conditions. This laid the groundwork for the growth of the cryptocurrency market in the country.

Today, South Africa has become one of the leading countries in Africa for cryptocurrency adoption, with an increasing number of merchants accepting digital currencies as a form of payment. Additionally, South African cryptocurrency exchanges have experienced significant growth, providing users with a platform to buy, sell, and trade various digital currencies.

There are several factors that have contributed to the rising popularity of cryptocurrency in South Africa:

When it comes to picking the ideal cryptocurrency platform in South Africa, there are several crucial aspects to take into account for a secure and efficient trading experience. Some of these factors include:

1. Reputation: Do your homework on the platform’s reputation by browsing user reviews and seeking advice from seasoned traders. A platform with a solid track record will give you that extra peace of mind.

2. Security: Ensure the platform values the safety of your funds and personal information. Keep an eye out for platforms that offer two-factor authentication (2FA), cold storage, and other cutting-edge security measures.

3. Trading fees: Compare trading fees across different platforms to find one with competitive rates. Some may charge a percentage of the trade, while others have a flat fee. And don’t forget to look for any hidden fees or charges!

4. User interface: A user-friendly interface is a must for seamless trading, especially if you’re a newbie. Opt for a platform that’s easy to navigate and comes with handy features like charting tools, order history, and real-time market data.

5. Customer support: When you’re in a bind, reliable customer support is invaluable. Choose a platform that offers swift and helpful support through various channels, such as email, phone, or live chat.

South Africa boasts several leading cryptocurrency platforms that cater to both novices and experienced traders. Some of the most sought-after platforms include:

1. Luno: Luno, a homegrown South African platform, boasts a user-friendly interface and a host of features like a built-in wallet, instant buy/sell options, and an advanced trading platform. Luno supports Bitcoin, Ethereum, Bitcoin Cash, and Litecoin.

2. VALR: Another local gem, VALR provides a comprehensive trading experience. It supports a wide range of cryptocurrencies and offers advanced trading features like limit orders, market orders, and stop orders. Plus, VALR delivers competitive trading fees and a secure trading environment.

3. AltCoinTrader: AltCoinTrader, a local favorite, supports various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple. It offers a user-friendly interface, competitive fees, and a safe trading environment.

4. Ice3X: Ice3X, a South African platform, offers a straightforward and easy-to-use interface for trading cryptocurrencies. It supports Bitcoin, Ethereum, and Litecoin and provides a secure environment for trading.

To make an informed decision when selecting a cryptocurrency platform, it’s essential to compare the fees, security measures, and features offered by each platform.

1. Fees: Compare trading fees across platforms to find one that suits your budget. Be mindful of additional fees, such as withdrawal or deposit fees, which can impact your overall trading costs.

2. Security: Examine the security measures implemented by each platform to guarantee the safety of your funds and personal information. Look for platforms that provide 2FA, cold storage, and other advanced security features.

3. Features: Assess the features offered by each platform to find one that meets your trading needs. Some platforms offer advanced trading tools, while others provide a more simple and user-friendly experience. Consider the cryptocurrencies supported by each platform, as well as any extra services like built-in wallets or instant buy/sell options.

By carefully evaluating and comparing these factors, you’ll be able to choose the ideal cryptocurrency platform in South Africa that best aligns with your needs and preferences. Happy trading!

So, you’ve decided to dip your toes into the world of cryptocurrency? Great! Let’s start by breaking down the basics. Cryptocurrencies like Bitcoin and Ethereum are digital or virtual currencies that use cryptography for security and run on a decentralized network called blockchain. Unlike traditional currencies, cryptocurrencies aren’t regulated by a central authority like a government or a central bank.

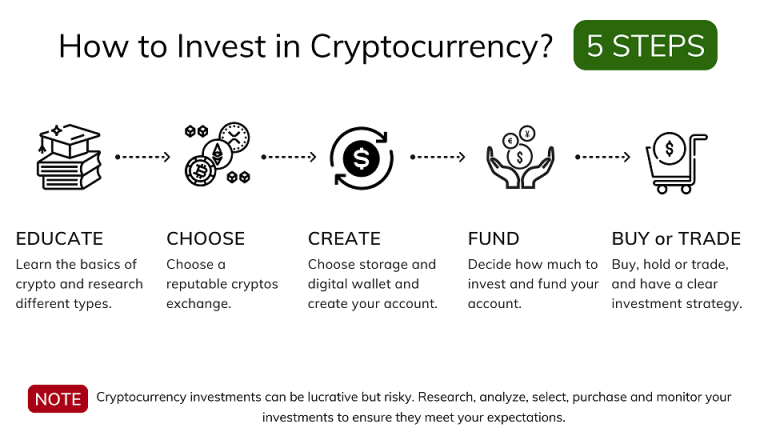

First things first, you need to choose a trustworthy cryptocurrency exchange platform where you can buy, sell, and trade cryptocurrencies. South Africans have plenty of options when it comes to reputable local and international exchanges. Do your homework and compare fees, security features, and user-friendliness before settling on a platform.

Next up is setting up a digital wallet to store your cryptocurrencies securely. You’ve got software wallets, hardware wallets, and paper wallets to choose from – each with their own pros and cons. Make sure to pick the one that best fits your needs and preferences.

Finally, dip your toes in by investing a small amount in one or more cryptocurrencies. This will give you a feel for the market and help you understand how it all works before you dive in headfirst with larger sums.

A well-thought-out investment strategy is key to long-term success in the cryptocurrency market. One of the best ways to manage risk is through diversification, which involves spreading your investments across a range of different cryptocurrencies. This way, if one asset isn’t performing well, it won’t drag your entire portfolio down with it.

Start by researching different cryptocurrencies and their underlying technologies to identify those with growth potential and long-term value. Remember that the cryptocurrency market is a rollercoaster ride, so it’s crucial to stay objective when evaluating investment options.

Risk management is another vital component of a solid investment strategy. This includes setting clear objectives, knowing your risk tolerance, and using stop-loss orders to limit potential losses. And please, don’t invest more than you can afford to lose – be prepared for the possibility of losing your entire investment.

The cryptocurrency market never sleeps, and staying in the loop about the latest trends, news, and developments is essential for successful investing. Here are some ways to keep your finger on the pulse:

By staying informed and updated on the latest trends and news in the cryptocurrency market, you’ll be better equipped to make informed investment decisions and adapt your strategy to the ever-changing market conditions. So go forth and conquer the world of cryptocurrency, and remember: fortune favors the bold!

In the land of the Springboks, cryptocurrencies are classified as intangible assets, and as you might have guessed, they are subject to taxation. The South African Revenue Service (SARS) has generously provided guidelines on how our beloved digital coins should be treated for tax purposes. Brace yourselves, dear crypto enthusiasts, as cryptocurrencies are subject to income tax, capital gains tax (CGT), and value-added tax (VAT).

When it comes to income tax, it’s the cryptocurrency traders and miners who need to pay attention. Profits made from trading cryptocurrencies are considered part of a taxpayer’s gross income and should be declared accordingly. Don’t try to hide it; SARS has eyes everywhere!

Capital gains tax, however, targets investors who hold cryptocurrencies as a long-term investment. Disposing of a cryptocurrency? The difference between the acquisition cost and the disposal value is seen as a capital gain or loss, and CGT swoops in to take a piece of the pie. The current maximum CGT rate for individuals stands at 18% – not too shabby, eh?

As for value-added tax (VAT), it applies to the supply of goods and services in South Africa. While the sale of cryptocurrencies is considered a financial service and is generally exempt from VAT, some cryptocurrency-related transactions, such as the supply of mining equipment or the provision of mining services, may be subject to VAT. You can’t escape the taxman entirely!

Fear not, fellow South Africans! Reporting your cryptocurrency transactions accurately can help you avoid penalties and interest. Follow these steps to report your cryptocurrency gains and losses on your tax return:

To effectively manage and minimize your cryptocurrency tax liability, consider the following tips:

By understanding the South African tax laws and regulations related to cryptocurrency and accurately reporting your gains and losses on your tax return, you can effectively manage your cryptocurrency tax liability and avoid potential penalties. Happy trading!

Investing in cryptocurrency can be a wild ride, and it’s crucial to understand the unique risks and threats that come with it. Here are some of the most common dangers you should be aware of:

To keep your cryptocurrency investments safe and sound, follow these best practices:

Hardware wallets are like digital Fort Knoxes that securely store your private keys offline, making them less vulnerable to hacking and theft. Some popular hardware wallets include the Ledger Nano S, Trezor, and KeepKey. It’s highly recommended to use a hardware wallet for storing significant amounts of cryptocurrencies.

In addition to hardware wallets, consider these extra security measures:

By understanding the risks associated with cryptocurrency investments and implementing the best practices and security measures mentioned above, you can keep your digital assets safe and enjoy the potential rewards of investing in this exciting market.