Are you interested in investing in cryptocurrencies but don’t want to break the bank? Look no further. In this article, we’ll be discussing the top cheapest cryptocurrencies to invest in South Africa, so you can start your investment journey without a hefty price tag.

Let’s talk about cryptocurrency – the digital or virtual currency that has taken the world by storm. Powered by cryptography and blockchain technology, these digital assets have opened doors to new financial opportunities and investment strategies. The beauty of cryptocurrencies lies in their decentralized nature, free from the control of any central authority like banks or governments. Instead, they rely on a network of computers to maintain their ledgers and validate transactions. Cool, right?

South Africa is rapidly emerging as a hotbed for cryptocurrency investments, and there are a few reasons behind this surge in popularity:

For those new to the crypto game, investing in budget-friendly cryptocurrencies can be a smart move. Here’s why:

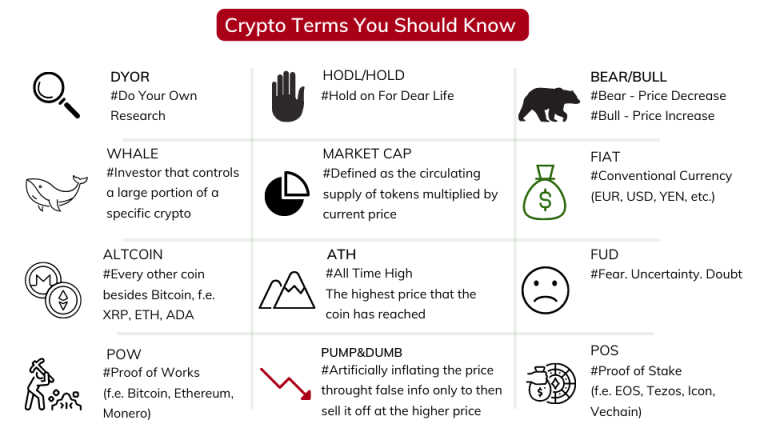

While going for cheaper cryptocurrencies can be a wise strategy, it’s essential to do your homework and consider other factors like market capitalization, technology, and adoption before making any investment decisions. After all, knowledge is power!

Ripple, also known as XRP, is a popular cryptocurrency that’s all about providing seamless, cost-effective, and lightning-fast cross-border transactions. As one of the most affordable cryptocurrencies with a rock-solid use case, it’s a no-brainer for investors in South Africa. XRP is designed to act as a bridge between different fiat currencies, making it an invaluable asset in the world of remittances and international payments. Ripple has established partnerships with major financial institutions worldwide, further enhancing its credibility and potential for growth. Talk about a powerhouse!

Next up on our list is Stellar Lumens, or XLM. Similar to Ripple, Stellar is all about enabling fast and low-cost cross-border transactions. However, Stellar’s primary target audience is individuals and small businesses, making it the people’s champ of cryptocurrencies. XLM is the native digital currency of the Stellar network, which allows users to make transactions in multiple currencies through a decentralized platform. With its growing adoption and numerous partnerships, Stellar Lumens presents a promising investment opportunity for those seeking an affordable entry point into the cryptocurrency market.

Meet Cardano, a blockchain platform that aims to provide a more secure, scalable, and sustainable ecosystem for the development and execution of smart contracts and decentralized applications (dApps). The native cryptocurrency of the Cardano platform is ADA, which is another affordable option for investors in South Africa. Cardano has a strong development team and a scientific approach to its platform’s design, which sets it apart from other cryptocurrencies. With its focus on sustainability, scalability, and security, Cardano is well-positioned for long-term growth, making it an attractive investment option for those looking for affordable cryptocurrencies.

Tron is a blockchain-based platform that aims to create a decentralized internet and enable the development of dApps and digital content sharing. TRX, the native cryptocurrency of the Tron network, is another affordable investment option for South Africans. Tron’s primary focus is on the entertainment industry, and it aims to revolutionize how content creators and consumers interact by removing intermediaries and allowing for direct transactions. With a strong community of supporters and an ambitious roadmap, Tron presents a unique opportunity for investors interested in affordable cryptocurrencies with potential for significant growth. Lights, camera, Tron!

Last but not least, we have VeChain, a blockchain platform that focuses on supply chain management and logistics. By leveraging blockchain technology, VeChain aims to create a more transparent and efficient supply chain ecosystem. The native cryptocurrency of the platform, VET, is an affordable option for investors in South Africa. VeChain has established partnerships with various industries, including automotive, luxury goods, and agriculture, which showcases its real-world use cases and potential for growth. As a result, VET is an appealing investment option for those looking for affordable cryptocurrencies with strong fundamentals and a promising future.

In summary, Ripple (XRP), Stellar Lumens (XLM), Cardano (ADA), Tron (TRX), and VeChain (VET) are five affordable cryptocurrencies for South African investors to consider. Each of these digital assets offers unique value propositions and use cases, making them attractive investment options in the ever-growing world of cryptocurrencies. By carefully evaluating each project’s fundamentals and potential for growth, investors can make informed decisions and potentially capitalize on the opportunities presented by these affordable cryptocurrencies.

When diving into the world of cryptocurrencies, it’s essential to keep an eye on market capitalization and trading volume. Market cap gives you a sense of the cryptocurrency’s size, stability, and growth potential. A higher market cap typically means a more mature and stable digital asset, while a lower market cap could mean you’re taking a walk on the wild side with higher risks and price fluctuations.

Trading volume, on the other hand, is like the heartbeat of a cryptocurrency. High trading volume means there’s strong liquidity, making it easy to buy or sell at the current market price. Low trading volume could indicate low demand, and let’s face it, nobody wants to be stuck with an asset that’s difficult to trade without affecting its price.

Let’s talk about the brains behind the operation: technology. When it comes to cryptocurrencies, a strong technological foundation can be the difference between a shooting star and a dud. Look for projects with unique features, solid tech, and clear use cases, like smart contract capabilities, lightning-fast transaction speeds, or groundbreaking consensus algorithms.

But what’s technology without utility? A digital asset with strong utility has a better chance of gaining widespread adoption and increasing in value over time. So, dig deep into the intended use cases for a cryptocurrency and determine if it’s solving a real problem or offering a unique solution. This can help you gauge its long-term potential and separate the contenders from the pretenders.

Behind every successful cryptocurrency, there’s a strong and active community. We’re talking about developers, investors, users, and enthusiasts who are all-in on the project’s growth and development. A strong community can drive adoption, contribute to the project’s development, and create a network effect that boosts the overall value of the cryptocurrency.

To evaluate community support, look for engaged social media followers, active developers, and positive sentiment within the community. And don’t forget about partnerships and collaborations with established companies – these can be game-changers for adoption and long-term potential.

Let’s face it: the regulatory environment can be a rollercoaster in the world of cryptocurrencies. Different countries have varying approaches to regulation, from supportive to downright restrictive. It’s crucial to understand the legal landscape in the country where the cryptocurrency project is based, as well as its potential impact on the global market.

And, of course, be aware of the risks associated with investing in cryptocurrencies. These may include market volatility, cybersecurity threats, and potential regulatory crackdowns. Remember, it’s essential to diversify your investments and manage your risk exposure accordingly. Stay informed about news and developments in the cryptocurrency industry and adjust your investment strategy as needed.

If you’re eager to dive into the world of cryptocurrencies in South Africa, you have two main options: local and international cryptocurrency exchanges. Local exchanges like VALR, Luno, and ICE3X are specifically designed for the South African market, accepting ZAR deposits and offering popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. These platforms usually have better liquidity for ZAR trading pairs and adhere to South African regulations. Sounds great, right?

However, don’t dismiss international cryptocurrency exchanges like Binance, Coinbase, and Kraken just yet! They offer a broader range of cryptocurrencies and trading pairs, but keep in mind that they might not support direct ZAR deposits or withdrawals. You might have to use an intermediary currency like USD or EUR, so watch out for exchange rates and conversion fees. Additionally, international exchanges may have lower fees than local ones, but it’s always essential to weigh the pros and cons before making a decision.

If you’re feeling adventurous, consider buying cryptocurrencies in South Africa through peer-to-peer (P2P) platforms or over-the-counter (OTC) trading. P2P platforms like LocalBitcoins and Paxful let you trade cryptocurrencies directly with other users without a centralized exchange, offering more privacy and the chance to negotiate prices and payment methods. Think of it as the Wild West of cryptocurrency trading!

For those who want to buy large amounts of cryptocurrency without causing a ripple in the market, OTC trading is the way to go. OTC desks like Binance’s OTC Portal or Kraken’s OTC Desk connect buyers and sellers directly, allowing them to execute trades at a fixed price. This method is perfect for institutional investors or high-net-worth individuals who want to avoid slippage and reduce trading fees.

So, you’ve got your hands on some shiny new cryptocurrencies. Now what? It’s time to store them securely in a wallet! There are various types of wallets, each with its own set of pros and cons. Here are some popular wallet options for South African cryptocurrency investors:

When choosing a wallet, consider factors like security, ease of use, compatibility with different cryptocurrencies, and support for advanced features like multisig and hardware wallet integration. Always do your homework and compare various wallet options before making a decision. After all, the safety of your cryptocurrency investments is paramount!

Did you know that in South Africa, cryptocurrency investments are treated as assets? That’s right! They’re subject to capital gains tax (CGT) when converted to cash. The South African Revenue Service (SARS) classifies cryptocurrencies as intangible assets, making them taxable. To avoid any unpleasant surprises or penalties, it’s crucial for investors to be aware of their tax obligations.

When you decide to cash in your cryptocurrencies, you must declare the profit or loss on your income tax returns. The CGT rate in South Africa ranges from 7.2% to 18% for individuals, depending on factors such as your total taxable income. For companies and trusts, the CGT rate is typically 22.4% and 36%, respectively. Just remember, tax regulations may change over time, so it’s essential to stay informed about any updates in tax laws related to cryptocurrencies.

There are several local and international exchanges available for South African investors to convert their cryptocurrencies to cash. Some popular local exchanges include Luno, VALR, and AltCoinTrader. These platforms offer various trading pairs, allowing users to trade their cryptocurrencies for South African Rand (ZAR) and subsequently withdraw the funds to their local bank accounts.

When choosing a platform, it’s essential to consider factors such as fees, security, and user experience. Typically, exchanges charge a fee for converting cryptocurrencies to fiat currencies and withdrawing funds to your bank account. So, don’t forget to compare fees and other features across different platforms to make an informed decision.

In addition to local exchanges, South African investors can also use international platforms such as Binance, Coinbase, and Kraken. These platforms offer a wider range of cryptocurrencies and trading pairs but may have higher fees and longer processing times for withdrawals to South African bank accounts.

While the adoption of cryptocurrencies for everyday transactions is still in its early stages, there’s a growing number of businesses and merchants in South Africa that accept cryptocurrencies as a form of payment. So, if you’re looking to utilize your crypto holdings without converting them to cash, you’re in luck!

To spend cryptocurrencies directly, you’ll need a digital wallet that supports the specific cryptocurrency and a merchant that accepts it as payment. Mobile apps like Coindirect and Luno offer wallet services that allow users to store, manage, and spend their cryptocurrencies with ease.

Furthermore, cryptocurrency debit cards are becoming more popular, providing users with a convenient way to spend their crypto holdings. These cards function similarly to traditional debit cards and can be used at any merchant that accepts card payments. Companies like Wirex and Crypterium offer cryptocurrency debit cards that can be used in South Africa.