Cryptocurrency stocks have become a popular investment choice in recent years. However, for South Africans looking to venture into this market, it can be overwhelming. In this beginner’s guide, we’ll break down everything you need to know about investing in cryptocurrency stocks in the South African market.

Cryptocurrency stocks, also known as blockchain stocks or crypto stocks, are shares of companies that are either directly or indirectly involved in the development, utilization, or support of cryptocurrencies and blockchain technology. These companies may operate cryptocurrency exchanges, develop blockchain applications, or provide essential services to the crypto ecosystem, such as mining and transaction validation.

The South African market has shown a growing interest in cryptocurrencies and their underlying technology, making it an attractive destination for investors looking to diversify their portfolios. This growth can be attributed to factors such as increasing internet penetration, a strong technology sector, and an increasing awareness of digital currencies among the general population. South Africa also boasts a thriving startup ecosystem, which has led to the emergence of several innovative blockchain and crypto-based companies.

The growing adoption of cryptocurrencies in South Africa has resulted in the rise of various cryptocurrency stocks in the market. Several established companies have entered the space, recognizing the potential of digital currencies and the benefits of blockchain technology. For example, some companies have launched cryptocurrency exchanges or partnered with existing exchanges to facilitate crypto trading for their users.

Moreover, South African startups are also capitalizing on this opportunity by offering innovative blockchain solutions in areas such as supply chain management, financial services, and digital identity verification. These companies are either directly involved in the cryptocurrency industry or indirectly contributing to its growth by enabling the use of digital currencies in various sectors.

The increased interest in cryptocurrencies has also attracted international investments into the South African market. Global companies looking to expand their presence in the growing African crypto market are investing in South African startups or partnering with local businesses to provide cryptocurrency-related services.

The regulatory environment for cryptocurrency stocks in South Africa is still developing. While the South African Reserve Bank (SARB) does not currently recognize cryptocurrencies as legal tender, it has taken a proactive approach in understanding and regulating the use of digital currencies.

In 2014, the SARB established a Financial Technology (FinTech) Program to research and develop appropriate policy frameworks for the emerging technology, including cryptocurrencies. In 2018, the SARB released a consultation paper on policy proposals for cryptocurrency assets, which provided recommendations on the regulation of cryptocurrencies and the services associated with them.

The South African Revenue Service (SARS) has also issued guidelines on the taxation of cryptocurrencies, stating that normal income tax rules apply to cryptocurrencies, and taxpayers must declare gains or losses on their digital currency transactions.

In 2020, the Financial Sector Conduct Authority (FSCA) published a draft declaration on crypto assets as a financial product under the Financial Advisory and Intermediary Services (FAIS) Act. If the declaration is finalized, it will require cryptocurrency service providers, such as exchanges and wallet providers, to register as financial service providers and comply with the FAIS Act.

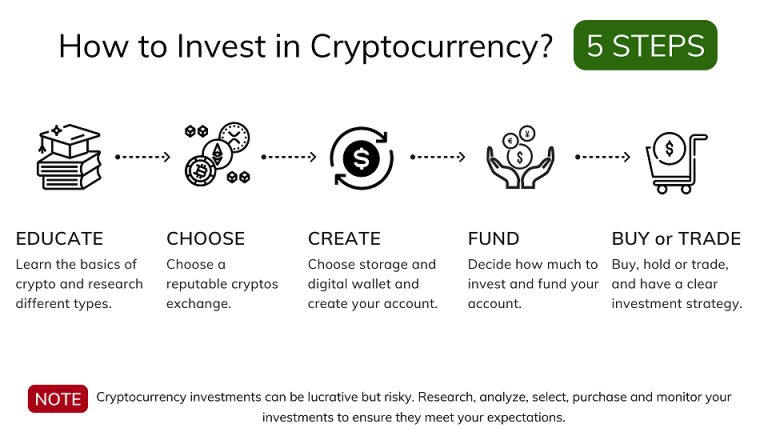

Investors looking to trade cryptocurrency stocks in South Africa should be aware of the evolving regulatory landscape and stay informed about the latest developments to ensure compliance with local laws and regulations. Remember, knowledge is power, and in the world of crypto investments, it’s a superpower!

Monero (XMR) is a privacy-focused cryptocurrency that has gained significant traction in South Africa. Monero Faucets are platforms that reward users with small amounts of XMR for completing various tasks, such as viewing ads, completing surveys, or participating in games. This enables users to accumulate Monero without having to invest directly in the cryptocurrency.

Some popular Monero Faucets in South Africa include CoinFaucet.io, MoneroFaucet.info, and XMR-Faucet.com. These platforms offer an easy and low-risk way for South African investors to get started with Monero, and can serve as an entry point to investing in the broader cryptocurrency market.

Apart from Monero, several other cryptocurrencies have gained popularity in the South African market. Here are a few noteworthy options for investors to consider:

As the cryptocurrency market continues to evolve, several emerging projects show promise for South African investors. Here are a few to watch closely:

As the cryptocurrency market in South Africa continues to mature, investors should remain vigilant and stay informed about emerging projects and trends. By keeping an eye on the most popular and promising cryptocurrency stocks, South African investors can capitalize on the vast potential of this rapidly evolving market.

When it comes to investing in cryptocurrency stocks in South Africa, the first major decision is whether to go for a short-term or long-term investment strategy. Each approach has its pros and cons, and your choice ultimately depends on factors like financial goals, risk tolerance, and time horizon.

Short-term investment strategies involve buying and selling cryptocurrency stocks within a relatively short period, usually days, weeks, or a few months. This approach aims to take advantage of market fluctuations and trends to generate quick profits. Short-term investors, often referred to as traders, need to be nimble and stay on top of market movements. While this strategy can be profitable, it also comes with higher risks, and you might face more transaction fees and taxes.

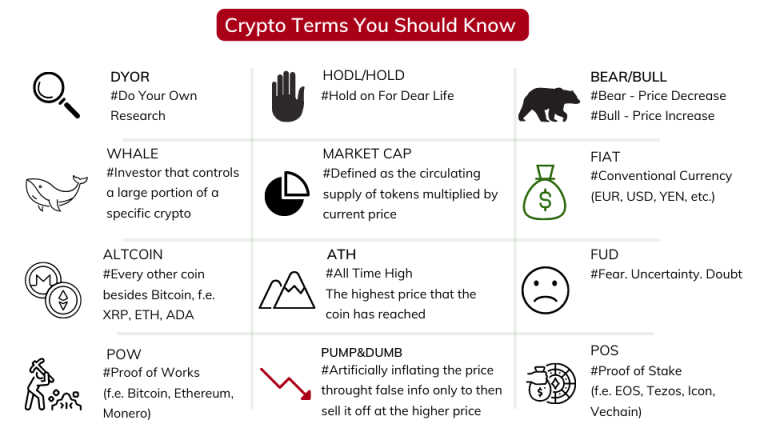

Long-term investment strategies, on the other hand, are all about holding onto cryptocurrency stocks for an extended period, typically years or even decades. This approach is based on the belief that the value of the stocks will increase over time, despite short-term market volatility. Long-term investors, also known as “HODLers” (Hold On for Dear Life), focus on the fundamentals of the cryptocurrency and its potential for growth. Although this strategy may yield lower returns in the short term, it often results in more significant gains in the long run and reduces the impact of fees and taxes.

Risk management is a critical aspect of investing in cryptocurrency stocks. Cryptocurrencies are notorious for their high volatility, which can cause significant price fluctuations within a short period. To protect your investments and maximize returns, it’s essential to diversify your portfolio.

Technical analysis is a popular method used by investors to analyze and predict the future price movements of cryptocurrency stocks. This approach involves examining historical price data and identifying patterns and trends that may indicate future performance.

Some of the most common technical analysis tools include moving averages, relative strength index (RSI), and support and resistance levels. These tools can help you identify entry and exit points for your investments, set stop-loss orders, and determine the overall direction of the market.

When using technical analysis, it’s essential to remember that past performance does not guarantee future results, and no single indicator can predict market movements with complete accuracy. Therefore, it’s crucial to combine technical analysis with fundamental analysis, which considers factors such as the cryptocurrency’s technology, team, and market potential.

By adopting a well-rounded investment strategy that incorporates short-term and long-term approaches, risk management, and technical analysis, you can increase your chances of success in the South African cryptocurrency stock market. And who knows, you might just become the next crypto guru everyone talks about at dinner parties!

When diving into the world of cryptocurrency stocks in South Africa, it’s essential to choose a trading platform that caters to your needs. These platforms provide a wide range of cryptocurrency stocks and trading tools, ensuring a seamless and enjoyable trading experience. Let’s explore some popular options:

When investing in cryptocurrency stocks, having access to reliable tools and resources is crucial. Here are some popular tools and resources to help you stay informed and make smart investment decisions:

With a plethora of trading platforms and tools available, it can be overwhelming to decide which ones best suit your needs. Here are some factors to consider when making your choice:

By considering these factors, you can choose the right trading platform and tools that best suit your needs, helping you effectively navigate the South African cryptocurrency stock market like a pro.

As the cryptocurrency market continues to grow in South Africa, it’s essential for investors to keep a close eye on potential government regulations and policies. After all, regulatory changes can significantly impact the value and stability of cryptocurrency stocks.

At present, South African authorities are actively working on developing a regulatory framework for cryptocurrencies. This could include measures such as licensing requirements for cryptocurrency exchanges, anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, as well as taxation policies for crypto assets. While these regulations can help legitimize the industry and protect investors, they may also impose additional costs and requirements for cryptocurrency businesses, which could affect stock prices.

Besides national regulations, investors should also be aware of global trends in cryptocurrency regulations, as these can indirectly impact the South African market. For instance, if major economies like the US, China, or the European Union impose strict regulations on cryptocurrencies, it could potentially lead to a global market downturn and affect South African cryptocurrency stocks.

The adoption of cryptocurrencies by South African businesses is another crucial factor to consider when preparing for the future of cryptocurrency stocks. As more businesses start accepting cryptocurrencies as a form of payment, it could lead to increased demand and higher valuations for cryptocurrency stocks.

In recent years, several prominent South African businesses have started accepting cryptocurrencies, such as online retailers, restaurants, and even property agencies. This growing trend indicates a growing acceptance of digital currencies in the country and could create new investment opportunities for cryptocurrency stock investors.

Furthermore, as more businesses adopt cryptocurrencies, it could lead to further development and innovation in the local cryptocurrency industry. This can result in the emergence of new cryptocurrencies and blockchain-based projects, providing investors with a more diverse range of investment options.

When it comes to the long-term prospects and growth potential of cryptocurrency stocks in South Africa, there are several factors to consider. Firstly, the global cryptocurrency market is still relatively young and volatile, with many analysts predicting significant growth in the coming years. This could present a wide range of opportunities for investors in the South African market, as local cryptocurrency stocks could benefit from the global market expansion.

Moreover, as South Africa’s economy continues to develop, the demand for alternative investment options and digital financial services is likely to increase. This could lead to a more significant adoption of cryptocurrencies and further growth in the local cryptocurrency stock market.

However, it is crucial for investors to be aware of the risks and challenges associated with investing in cryptocurrency stocks. These include the potential for regulatory changes, market volatility, and the relatively untested nature of many cryptocurrencies and blockchain projects. Therefore, investors should approach the market with caution and ensure they diversify their investment portfolios to manage risk effectively.