Crypto staking is becoming increasingly popular among investors in South Africa, and for good reason. Staking platforms offer a variety of features and rewards, making them an attractive option for those looking to earn passive income from their cryptocurrency investments. In this article, we’ll take a closer look at some of the top staking platforms available in South Africa and explore their unique benefits.

At its core, crypto staking is all about participating in the validation of transactions on a blockchain network. By locking up a certain amount of a cryptocurrency in a wallet, you’re not only helping to maintain the security and stability of the network, but also earning some sweet rewards in the process. These rewards come in the form of transaction fees and/or newly minted coins, depending on the consensus algorithm used by the blockchain.

But what’s the big deal about staking, you ask? Well, the primary benefit of crypto staking is the passive income generated by the staking rewards. By holding and staking a cryptocurrency, investors can earn a return on their investment without actively trading or selling their assets. This can be particularly appealing for long-term investors who believe in the future growth and adoption of a specific blockchain project. Plus, staking helps decentralize and secure the network as more participants join and contribute to its maintenance. Talk about a win-win situation!

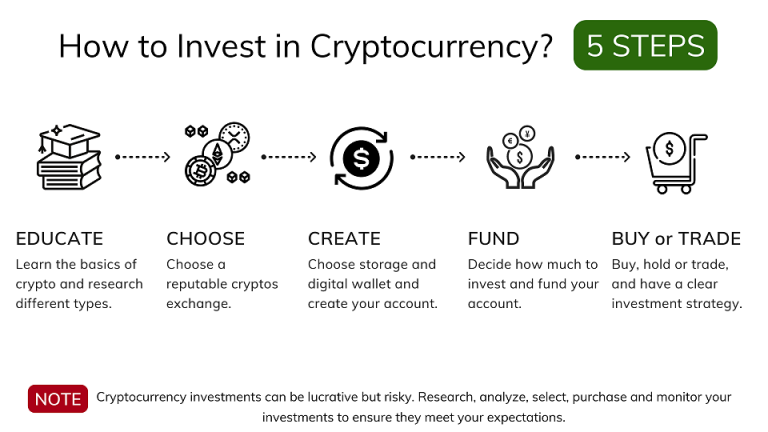

Enter crypto staking platforms – services that make it super easy for users to stake their cryptocurrencies without breaking a sweat. These platforms take away the headache of running a validator node and dealing with the technical complexities associated with it, allowing investors to participate in staking without having to manage the hardware and software requirements.

Staking platforms typically offer a range of supported cryptocurrencies, allowing users to choose the assets they wish to stake. Here’s how it works:

Rewards generated from staking are distributed to users based on their proportionate contribution to the platform’s total staked assets. Keep in mind that some platforms charge a fee for their services, which may be deducted from the user’s staking rewards.

When it comes to the regulatory landscape for cryptocurrency and crypto staking in South Africa, things are still in their early stages. The South African Reserve Bank (SARB) has stated that cryptocurrencies are not recognized as legal tender but has not banned their use or trade. In 2019, the Intergovernmental Fintech Working Group (IFWG) released a position paper providing recommendations for a regulatory framework for cryptocurrencies, including staking.

Currently, there are no specific regulations governing crypto staking platforms in South Africa. However, it is expected that any future regulatory framework for cryptocurrencies will include provisions for staking platforms, ensuring compliance with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations, as well as consumer protection and market integrity standards.

As the regulatory environment evolves, it’s crucial for investors to stay informed about any changes that may impact their staking activities. This includes keeping an eye on updates from regulatory bodies such as the SARB and IFWG, as well as engaging with reputable platforms that prioritize transparency and compliance with existing financial regulations.

So, if you’re a South African investor looking to dip your toes into the world of crypto staking, make sure you’re well-versed in the benefits and mechanics of crypto staking, as well as the current regulatory environment. With this knowledge in hand, you’ll be well-equipped to make informed decisions about participating in this emerging sector of the digital asset market.

Binance, the world’s largest cryptocurrency exchange by trading volume, offers a comprehensive staking platform for South African users. With a wide range of supported cryptocurrencies, including popular coins like Ethereum 2.0, Cardano, and Polkadot, Binance provides an easy way to earn passive income through staking.

One of the key advantages of Binance’s staking platform is its flexibility, allowing users to stake coins without any minimum holding period or lock-up period. This means that users can start earning rewards immediately after depositing their coins into the platform. Furthermore, Binance’s staking platform is known for its competitive interest rates, which can be as high as 20% per annum for some coins.

Kraken, a popular US-based cryptocurrency exchange, offers a secure staking platform for South African users. Known for its commitment to security, Kraken provides a safe environment for staking and trading various cryptocurrencies, including Bitcoin, Ethereum, Polkadot, and Tezos.

Kraken’s staking platform is user-friendly and offers a range of staking options, including on-chain staking, off-chain staking, and even staking for Ethereum 2.0. Additionally, Kraken’s staking platform provides competitive interest rates, with rewards paid out twice a week. Users can also benefit from Kraken’s advanced trading features and tools, making it an ideal choice for both staking and trading enthusiasts.

MyCointainer is a dedicated staking platform that offers a simple and user-friendly experience for South African users. With support for over 100 different cryptocurrencies, MyCointainer aims to make staking accessible to everyone, regardless of their level of expertise.

One of the standout features of MyCointainer is its automatic reward distribution, which allows users to earn passive income without needing to manage their staking activities actively. MyCointainer also offers a unique Power Plus plan, which enables users to earn additional rewards by holding the platform’s native token, MyCointainer Power (MCP).

Polkadot is a next-generation blockchain platform that allows users to stake its native token, DOT, while also providing a framework for building decentralized applications (dApps). With its unique consensus mechanism, known as Nominated Proof of Stake (NPoS), Polkadot enables users to earn staking rewards while contributing to the platform’s security and decentralization.

South African users can stake their DOT tokens through Polkadot’s native staking platform, known as the Polkadot UI, or via various third-party platforms, such as Binance and Kraken. Staking rewards on Polkadot can range from 10% to 15% per annum, depending on the platform and the number of tokens staked.

Tezos is a decentralized blockchain platform that features on-chain governance, allowing token holders to participate in the platform’s decision-making process. Tezos uses a unique consensus mechanism called Liquid Proof of Stake (LPoS), which enables users to earn staking rewards by delegating their tokens to validators known as bakers.

South African users can stake their Tezos (XTZ) tokens through various platforms, including Binance, Kraken, and dedicated Tezos wallets like Galleon and Kukai. Staking rewards on Tezos can vary depending on the platform and the amount of XTZ delegated, with annual returns typically ranging from 5% to 7%.

By exploring these top crypto staking platforms available in South Africa, users can find the best option for their needs and start earning passive income through staking. Each platform offers unique features, supported cryptocurrencies, and reward structures, making it essential to compare and evaluate them before making a decision. So, go ahead and dip your toes into the world of staking and enjoy the passive income that comes with it!

When diving into the world of crypto staking platforms in South Africa, the earning potential across various platforms is a key factor to keep in mind. Staking rewards can differ based on aspects like the selected cryptocurrency, platform fees, and staking duration. Let’s take a quick look at some popular platforms:

Safeguarding your digital assets and ensuring a platform’s trustworthiness are crucial. Each platform employs different security measures to protect users’ funds and personal information:

Nothing turns users away faster than a clunky interface and poor accessibility. A user-friendly interface, mobile app availability, and responsive customer support can make all the difference in the world:

So, when comparing crypto staking platforms in South Africa, remember to weigh factors like earning potential, security measures, and user experience. Binance and Kraken lead the pack as centralized platforms, while MyCointainer offers an extensive range of staking options with high rewards. Polkadot and Tezos provide unique decentralized solutions with their own perks. Ultimately, the platform you choose will depend on your personal preferences, investment goals, and risk tolerance. Happy staking!

To maximize rewards from crypto staking, it’s essential to optimize your portfolio. Begin by diving deep into research about different cryptocurrencies and their respective staking models. Keep in mind that each cryptocurrency has its staking mechanism, minimum staking requirements, and reward rates. Hunt for the ones with the most attractive staking rewards and think about diversifying your investments across multiple cryptocurrencies to minimize risk.

Take note of the lock-up period and the time required for staking. Some cryptocurrencies may ask you to lock up your funds for a specific time before you start earning rewards. It’s crucial to strike the right balance between potential rewards and the liquidity of your assets.

Another key aspect is the staking platform you choose. As mentioned earlier, platforms like Binance, Kraken, and MyCointainer offer different staking services. Be sure to compare their fees, minimum staking requirements, and the coins they support. In an ideal world, you’d pick a platform that supports multiple cryptocurrencies, boasts low fees, and flaunts a user-friendly interface.

While staking cryptocurrencies can be a source of passive income, it also carries risks. The most common risks tied to crypto staking include market volatility, staking platform security, and the potential for lower returns than expected.

Market volatility can have a significant impact on the value of your staked assets. As cryptocurrency prices ebb and flow, the value of your staking rewards may follow suit. To minimize this risk, think about diversifying your portfolio across different cryptocurrencies and keeping a watchful eye on market trends.

Security is another vital aspect to consider when staking your crypto assets. Choose platforms with a solid security track record and store your private keys securely. Give some thought to using hardware wallets or cold storage solutions to safeguard your assets from potential hacks and unauthorized access.

When it comes to staking, it’s vital to have realistic expectations regarding potential returns. Staking rewards are often swayed by factors like the number of stakers, staking requirements, and market conditions. To manage your expectations and ensure you’re making informed decisions, stay in the loop on crypto market news and research the specific staking mechanisms of the cryptocurrencies you’re interested in.

In South Africa, the South African Revenue Service (SARS) treats cryptocurrencies as intangible assets, subject to income tax and capital gains tax. As a result, staking rewards are also on the taxman’s radar.

When you earn staking rewards, they’re considered part of your taxable income, and you must declare them on your annual tax return. The tax rate will hinge on your overall income and the applicable tax brackets. Maintain detailed records of your staking activities, including the date, value, and type of cryptocurrency received as rewards.

In addition to income tax, you may also face capital gains tax when you sell or exchange your staked assets. If you hold your staked assets for more than three years, they may qualify for the long-term capital gains tax rate, which is generally lower than the short-term rate. Consult a tax professional to ensure you’re accurately reporting your staking rewards and capital gains on your tax return.

By optimizing your portfolio, understanding risks, and managing your crypto assets, you can maximize your rewards from crypto staking in South Africa. Stay aware of the tax implications and keep yourself informed about market trends and regulatory changes to make the most of your staking investments. And remember, fortune favors the bold (and well-informed)!

Remember, the future of crypto staking platforms in South Africa will be shaped by emerging technologies, regulatory changes, and global crypto trends. Staying informed and adaptable is the key to making the most of the opportunities in this exciting and evolving digital asset ecosystem. Happy staking!